Jon Von Hoffma | Sr Loan Officer

Speed, Service, Success.

Your Mortgage, My Mission

I’m here to answer your questions and find solutions to help you reach your home financing goals—whatever they may be.

About Me

With 22+ years of experience, I help Golden 1 members in Sacramento secure home loans—whether buying, refinancing, or accessing home equity.

As your Home Loan Advisor, I guide you from pre-qualification to closing, ensuring you understand your options and stay informed. I handle the process so you can focus on your goals.

I’m committed to clear answers, smart solutions, and building lasting relationships.

Jon Von Hoffman

Golden 1 Credit Union

NMLS #1099516

What My Clients Say

"Jon is a fantastic resource in navigating the mortgage loan process. Kind, honest, and transparent, I would definitely recommend him and his team for your hone lending needs."

Seth M Wight

Development Project Manager

"First and foremost, Jon is always very pleasant and respectful when I am dealing with him. This mortgage makes my 3rd experience working with Jon, and I would recommend his services even if he were to move to a different bank."

Raymond Valido

Systems Engineer

"Jon was awesome! He was available day and night to answer all of our questions, and we called late at night a few times. We are very happy he was the one to help us through this process. I highly recommend him to anyone! Thanks again for a great experience Jon!"

Andrew Simpkins

Clinical Care Coordinator

I Know Mortgages.

I partner with lenders who share my beliefs that applying for a mortgage or financing should be fast, simple, and secure.

Ready to buy your first home

There are many things to think about when buying your first home. Professional mortgage advice is a great place to start.

Mortgage Refinancing

Get out of a high rate mortgage, or unlock some of your home equity for debt consolidation or other important need.

Mortgage Renewals

At renewal, you can renegotiate everything pertaining to your mortgage - with no penalties. It's also a great time to save money!

Find out what you can afford

Examine the financial implications of what may prove to be the most important financial decision of your lifetime.

Frequently Asked Questions

Get answers to your most common questions about residential mortgages.

What is a first-time homebuyer?

Generally, a first-time homebuyer is someone who hasn’t owned a primary residence in the past three years. You can also be considered a first-time buyer if:

You’ve shared ownership of a house with a spouse in the past but are now buying solo.

You’ve been renting or living with family.

You haven’t held a mortgage in three years.

You’re buying in a designated redevelopment area, where certain programs have less strict rules.

Am I ready to purchase a home?

If you’re wondering if you’re ready to buy a house, consider these three factors:

Financial stability: If you have a low credit score, lots of debt, and not enough funds to cover a down payment and closing costs, you may want to wait to buy a home.

Job security: Stable employment and income are key indicators for lenders when qualifying for a mortgage.

Future plans: It might not be a good time to buy a home if you plan on moving in two years or less.

How long should I plan on living in this house?

While there’s no golden rule for how long you should plan to live in your first home, it’s ideal to stay at least several years.

This way, you’ll have a chance to build equity.

The longer you own your home, the more equity you’ll build, leading to greater financial return when you decide to sell your home.

When is it a good time to buy a house?

Ultimately, it’s a good time to buy a home when you’re ready for it. Your financial readiness and long-term goals are both great factors to think about.

On top of that, it’s also smart to check your local housing market trends and mortgage interest rates.

Speak with a real estate agent to help determine if you’re in a good position to begin the homebuying process.

How much money do I need to buy a house?

Most homebuyers will need to think ahead about the following costs when estimating how much money is needed to purchase a home:

Down payment: The down payment is a percentage of the home’s purchase price, anywhere from 0% to 20% depending on your loan. For example, a 10% down payment on a $500,000 home would be $50,000.

Closing costs: Typically 2-5% of the home’s purchase price. It covers a variety of fees like lender and title fees, property taxes, home inspection, and homeowners insurance, to name a few.

Moving expenses: These can include hiring movers, transportation, and purchasing packing supplies.

Emergency fund: It’s wise to have 3-6 months’ worth of living expenses for unexpected costs.

Ongoing costs: Beyond your mortgage payment, be prepared for ongoing expenses such as property taxes, utilities, maintenance, and homeowners insurance.

How much house can I afford?

On the same topic, it’s important to know how much house you can afford. You can estimate affordability with your current income and down payment. Make sure to also account for closing costs, insurance, and additional fees.

You’ll also want to consider your debt-to-income (DTI) ratio, which is a primary concern for lenders.

This measures your debt payments each month in relation to your gross monthly income.

While some lenders allow a DTI up to 43% or higher, they typically follow the 28/36 rule: You should allocate no more than 28% of your monthly income on housing, and no more than 36% on debt payments.

What credit score is needed to buy a home?

While it’s beneficial to have a great credit score, there are loans that cater to buyers with lower ones.

It’s important to note, however, that your credit score influences your interest rate and loan options. Here are the minimum credit scores needed to qualify for certain loans:

Conventional loans: 620-660

Jumbo loans: 700

FHA loans: 500-580

VA loans: no requirement

USDA loans: typically 620, but can be lower

How much is a down payment on a house?

A common myth is that you need a 20% down payment in order to buy a house.

While putting 20% down is beneficial, it’s not required. Several loan options, such as FHA or VA loans, only require a down payment of 3.5% or 5%.

Keep in mind that there may be additional costs associated with a down payment under 20%, like paying for private mortgage insurance (PMI).

Can I buy a house with no down payment?

The short answer is yes. You can buy a home with no down payment. There are two loans available that allow you to buy a home with zero down:

VA loans offer no-down payment loans for active-duty service members, veterans, qualifying spouses, and current or past members of the National Guard or Reserve, and other beneficiaries who meet the criteria.

USDA loans, backed by the U.S. Department of Agriculture, offer zero-down payment mortgages for qualifying homebuyers purchasing in specific rural or suburban areas.

If you don’t qualify for one of these programs, there are plenty of low-down payment loan options and down payment assistance programs.

What are the closing costs?

Closing costs encompass a variety of fees associated with finalizing a home purchase. These typically include:

• An appraisal fee to assess the home’s value

• Title fees for searches and insurance

• Lender fees for processing the loan

Other common expenses can include legal fees, recording fees, prepaid property taxes, or homeowner’s insurance. In general, closing costs range from 2% to 5% of the loan amount, though this can vary depending on the location and services required.

Testimonials

John Doe

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Jane Doe

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Let's Get In Touch

Phone:

(916) 336-8079

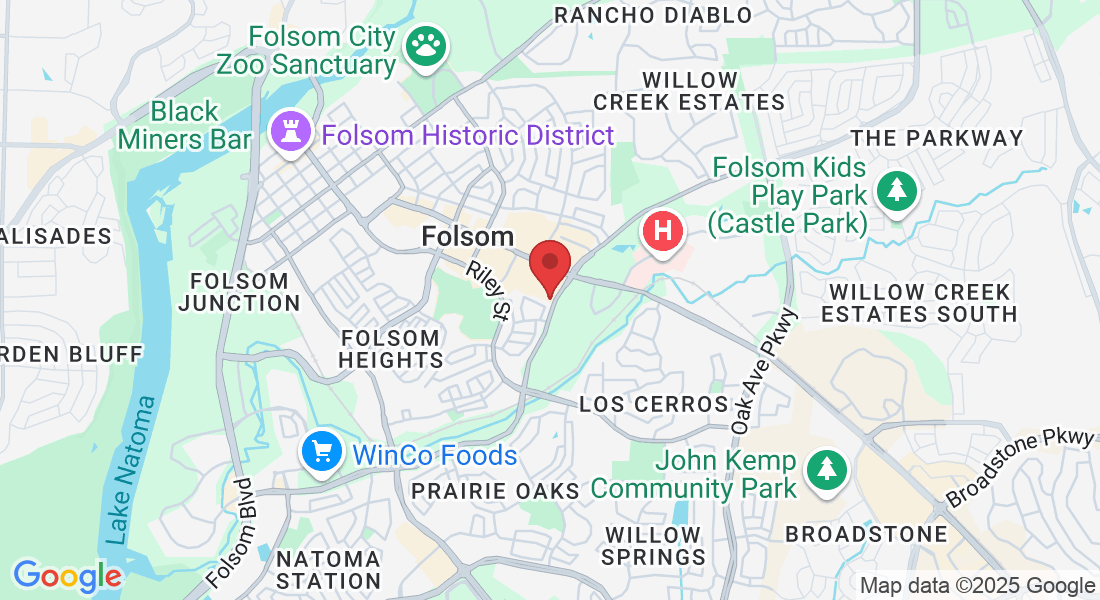

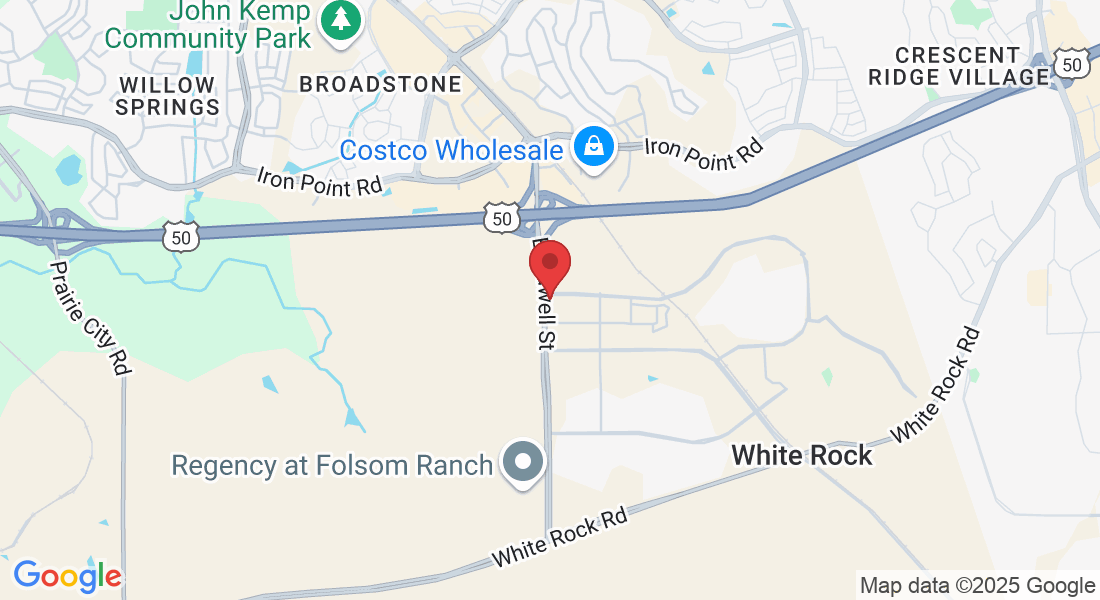

Office:

1117 East Bidwell Street,, Folsom California 95630

Email:

Copyrights 2025 | JonVonHoffman.com | Terms & Conditions